unified estate and gift tax credit 2020

As an overview the unified credit for estate and lifetime gift tax purposes is currently 5340000 per person. Ad Access IRS Tax Forms.

Indiana Unified Tax Credit For The Elderly

This means that a person can gift during their lifetime or at death up to this amount without implication of an estate or gift tax or some combination of the two.

. For 2020 US residents and citizens are entitled to a US estate tax unified credit of approximately 4577800 which essentially exempts 1158 million of property from estate tax. Ad Post Details Of Your Tax Preparation Requirements In Moments Completely Free. Any tax due is determined after applying a credit based on an applicable exclusion amount.

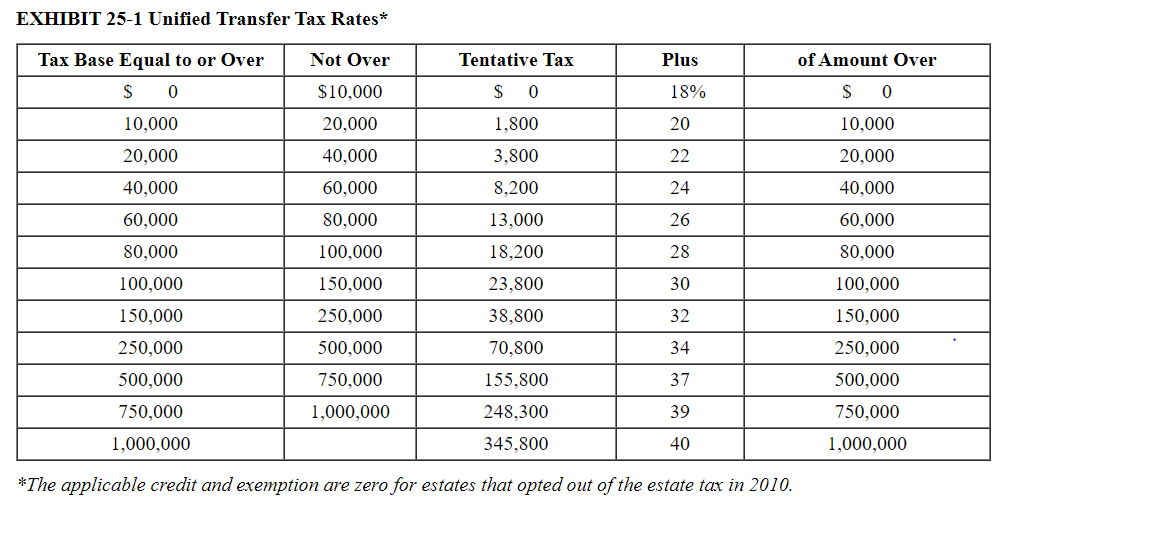

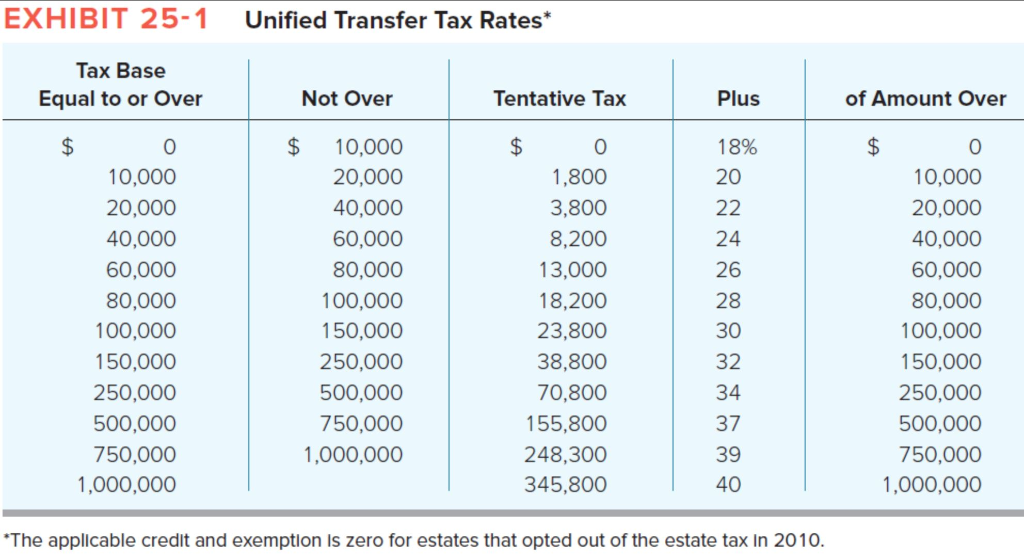

This credit is significant as amounts above this level will be taxed at rates starting at 18 and gradually increasing to 40 as of 2020 based on the size of the estate. With TurboTax Its Fast And Easy To Get Your Taxes Done Right. This is called the unified credit.

For 2022 the exemption increases to 1206 for individuals and 2412 for married couples filing jointly up from 117 million and 234 million respectively for 2021. The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate tax. A unified tax credit is the credit that is given to each person allowing him or her to gift a certain amount of money each year without having to pay gift estate or generation-skipping transfer taxes.

The federal estate tax gift and estate tax exemption amount is now 114 million indexed for inflation which is an all-time high. Gifts and estate transfers that exceed 1206 million are subject to tax. The Internal Revenue Service announced today the official estate and gift tax limits for 2020.

The estate and gift tax exemption is. Finding Tax Preparers in Your Area Is Easy with Bark. For 2021 that lifetime exemption amount is 117 million.

In other words use it or lose it. Ad File Your Taxes Online for Free. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of 55 to a n.

The previous limit for 2020 was 1158 million. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed. Find some of the more common questions dealing with basic estate tax issues.

It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit. The estate tax is a tax on your right to transfer property at your death. In addition to the unified tax credit individuals can give up to 15000 a year to a recipient or recipients 15000 per gift to as many recipients regardless of how many people you gift and not have to pay a gift tax.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. The IRS refers to this as a unified credit Each donor the person making the gift has a separate lifetime exemption that can be used before any out-of-pocket gift tax is due. For 2021 the estate and gift tax exemption stands at 117 million per person.

Get Your Max Refund Today. The federal exemption amount is also now portable between spouses. As of 2021 married couples can exempt 234 million In 2022 couples can exempt 2412 million.

Gift and Estate Tax Exemptions The Unified Credit. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit. Complete Edit or Print Tax Forms Instantly.

The unified tax credit is designed to decrease the tax bill of the individual or estate. Then there is the exemption for gifts and estate taxes. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

The IRS announced new estate and gift tax limits for 2021 during the fall of 2020. A married couple can transfer twice that amount to children or others or 228 million without any federal gift and estate tax. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to.

The unified tax credit is designed to decrease the tax bill of the individual or estate. Non-resident aliens are entitled to a US estate tax unified credit of 13000 which exempts 60000 of property from estate tax. If a gift is given as a present interest gift meaning it is given outright to a person then the amount is not added into your total lifetime unified gift and estate tax credit.

The Unified Tax Credit represents the amount of assets that an individual is allowed to gift to other parties without having to pay gift estate or generation-skipping transfer taxes. Instead these gifts are limited to 15000 per person annually. This also includes GSTT gifts generation-skipping transfer tax gifts which are gifts to those more than one.

Learn about the COVID-19 relief provisions for Estate Gift. The lifetime gift tax exclusion was expanded under the Tax Cuts and Jobs Act and with an inflation adjustment in 2020 increased. Specifically the unified credit allows you to give up to 15000 to anyone each year without having to file a gift tax return form with the IRS.

The unified credit is per person but a married couple can combine their exemptions. The lifetime gift tax exclusion in 2020 is 1158 million meaning the federal tax law applies the estate tax to any amount above. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. In 2020 after adjustment for inflation it was raised to 1158 million for individuals and 2316 million for a married couple. That number is used to calculate the size of the credit against estate tax.

It consists of an accounting of everything you own or have certain interests in at the date of death. A key component of this exclusion is the basic exclusion amount BEA. Estate and Gift Taxes.

The IRS places restrictions on gifts given to people other than your spouse. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure.

Indiana Unified Tax Credit For The Elderly

Solved In 2010 Casey Made A Taxable Gift Of 5 Million To Chegg Com

Planning For Year End Gifts With The Gift Tax Annual Exclusion Mauldin Jenkins

Locking In A Deceased Spouse S Unused Federal Estate Tax Exemption

Inflation Adjusted 2021 Transfer Limits For Gifts And Estates Ym Attorneys

Great Time For Grats Transfer Wealth With Minimal Gift Tax Or Estate Tax Domani Wealth

Arlington Law Group Estate Planning With Irrevocable Trusts

Suppose Vince Dies This Year With A Gross Estate Of Chegg Com

Can I Bequeath My Home To My Children Without Taxes Legacy Design Strategies An Estate And Business Planning Law Firm

![]()

Factor 2020 Cost Of Living Adjustments Into Your Year End Tax Planning Ds B

Is That Gift Taxable Irs Form 709 John R Dundon Ii Enrolled Agent

Direct Payment Of Medical Expenses And Tuition As An Exception To The Gift Tax The American College Of Trust And Estate Counsel

3 Transfer Taxes To Avoid In Your Houston Estate Plan

Planning For Year End Gifts With The Gift Tax Annual Exclusion Doeren Mayhew Cpas

![]()

Factor 2020 Cost Of Living Adjustments Into Your Year End Tax Planning Ds B

![]()

Valuation Discounts For Family Businesses Coming To An End Geiger Law Office

Can Gifting Assets To Family Help Me Avoid Federal Estate Taxes

What You Need To Know About The 11 Million Estate Tax Exemption Going Away