child tax credit 2021 dates by mail

The payment for the earned income credit or noncustodial parent earned income credit is 25 of the amount of. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll.

. Increases the tax credit amount. You can check eligibility requirements for stimulus payments on IRSgov. Ad Receive the Child Tax Credit on your 2021 Return.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100. August 19 2022.

5 hours agoHouseholds making less than 12500 and married couples making under 25000 can turn in a simplified tax return via a website the federal government built for the child tax credit payments. By August 2 for the August. The Empire child tax credit in New York offers support to families with kids above the age of four but below 17 with an income-based program.

This month Rhode Island families can similarly claim 250 per child and up to 750 for three children. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

This is a 2021 Child Tax Credit payment that may have been received monthly between July and December. 15 opt out by Nov. 13 opt out by Aug.

1400 in March 2021. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Besides the July 15 payment payment dates are.

The requirement to be among the lucky recipients are simple. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. Heres what to know.

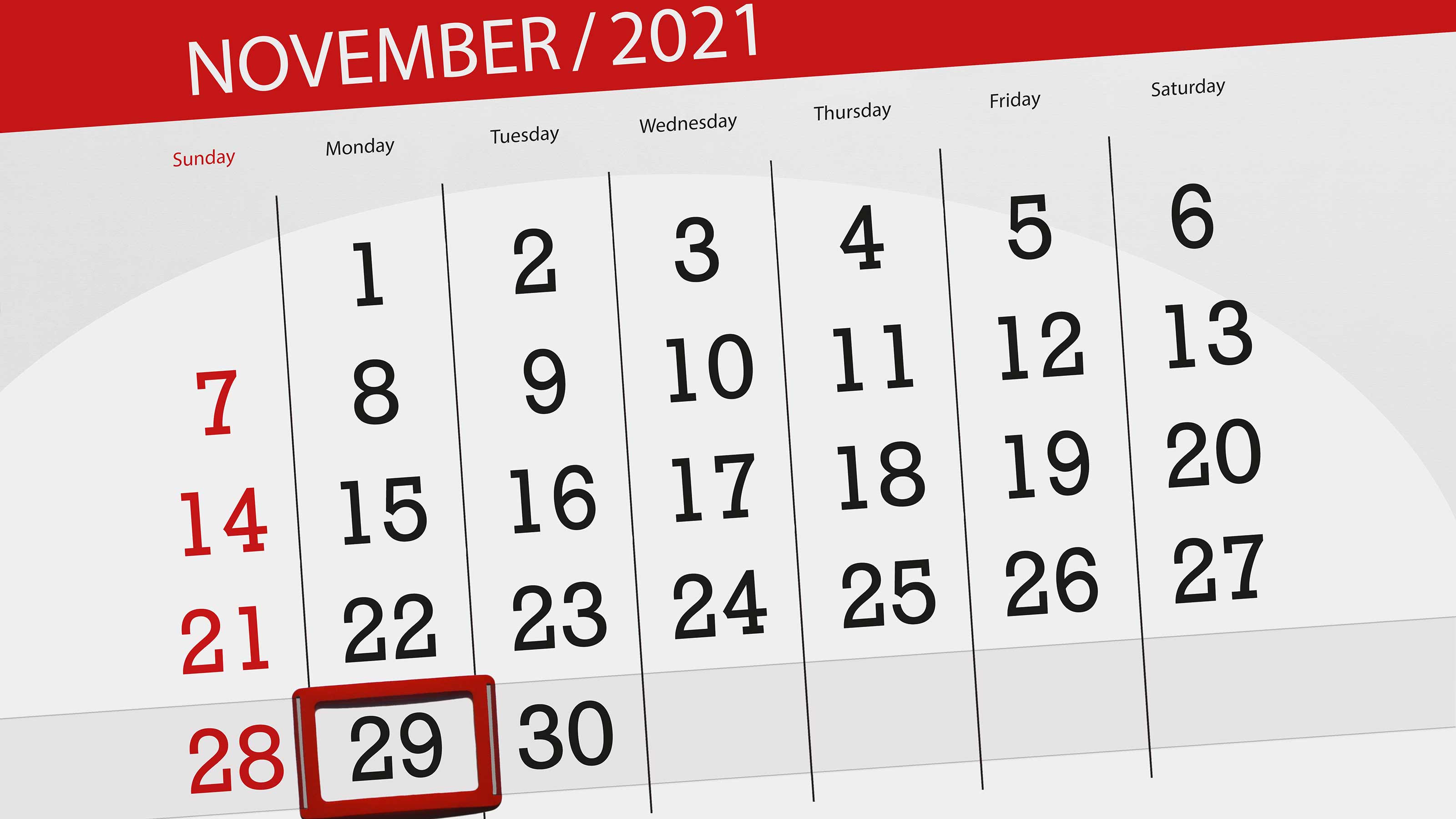

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Discover Helpful Information And Resources On Taxes From AARP. NEARLY two million households will start receiving tax credit payments in the coming weeksNew York residents who filed their taxes for 2021 and recei.

January 26 2022. 600 in December 2020January 2021. Even if you dont owe taxes you could get the full CTC.

This is an up to 1400 per person Economic Impact Payment provided by the American Rescue Plan. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Parents can expect to.

1 day agoAcross the state about 18 million residents will receive a refund check in the mail. IRS TREAS 310 TAX. File Federal Taxes to the IRS Online 100 Free.

If that included you you may be wondering how the advance and the other Child Tax Credit changes will affect your 2021 tax return. The maximum child tax credit. Those who got the 2021 child credit will receive between 25 to 100 of that amount depending on their income.

The percentage depends on your income. 15 opt out by Aug. If you didnt set up direct deposit you will get a cheque in.

The 2021 CTC is different than before in 6 key ways. All payment dates. They are going to people who filed for an Empire.

15 opt out by Oct. Millions of American families received monthly advance Child Tax Credit payments in 2021. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child.

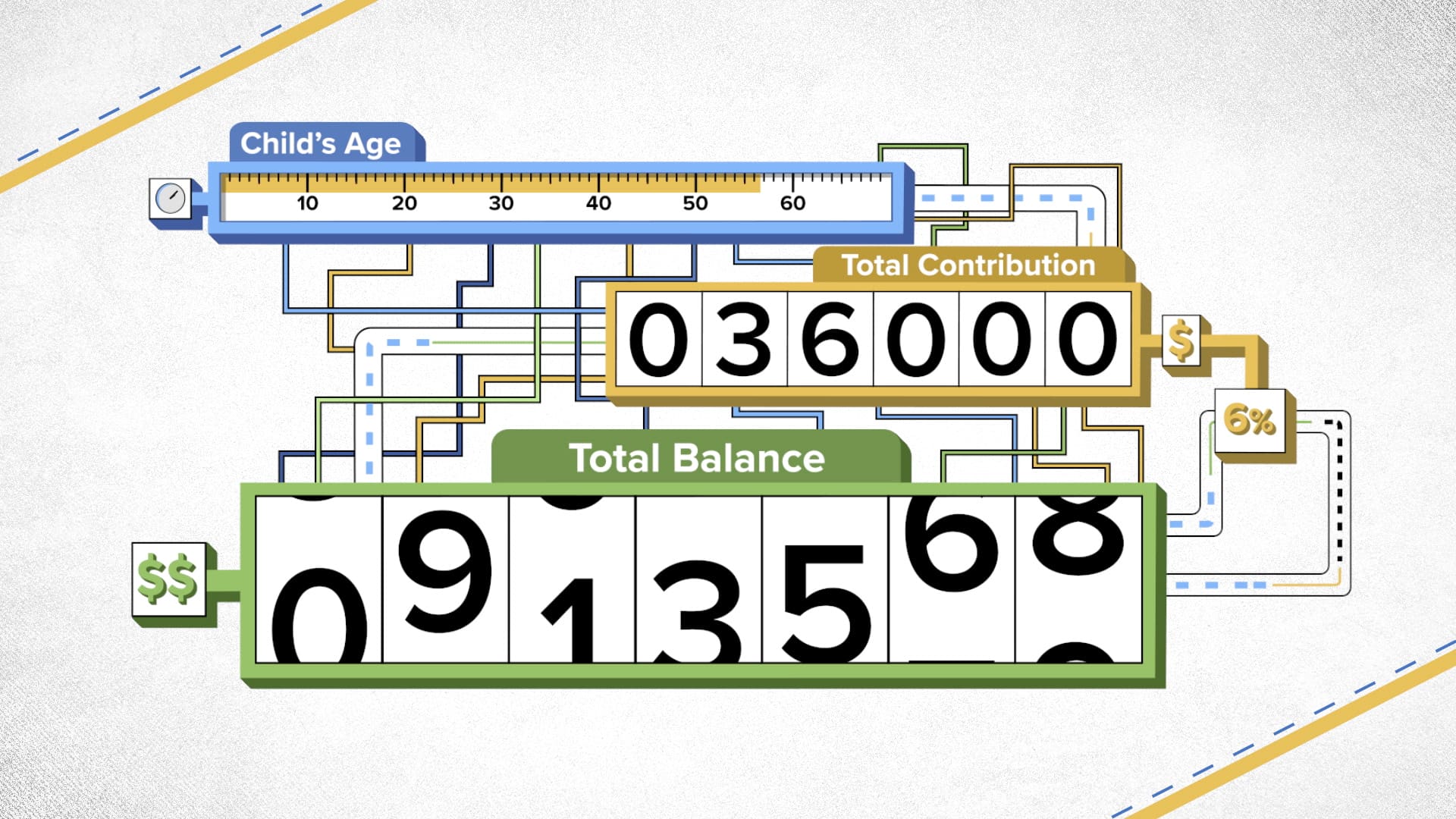

Payments for the new 3000 child tax credit start July 15. The total child tax credit for 2021 is up to 3600 per child age 5 and under and up to 3000 for each qualifying child age 6-17. The tax credits maximum amount is 3000 per child and 3600 for children under 6.

IRS TREAS 310 TAXEIP3. IRS TREAS 310 CHILDCTC. Check On Your Stimulus.

Makes the credit fully refundable. If you have a 3-year-old you likely received 300 a month from July through December for a total of up to 1800. If you chose to set up direct deposit your money gets deposited into your no fee chequing account on these dates.

Child Tax Credit Dates Here S The Entire 2021 Schedule Money

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

What Is The Child Tax Credit And How Much Of It Is Refundable

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

Advance Payments Of The Child Tax Credit The Surly Subgroup

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

Child Tax Credit What You Need To When Filing Your 2021 Taxes Khou Com

Dates For The Advanced Child Tax Credit Payments

Child Tax Credit Update A Portal To Update Bank Details And Facilitate Payments Marca

2021 Advanced Child Tax Credit What It Means For Your Family

Irs Launches New Address Update Feature For Child Tax Credit Payments Maui Now

These Are All The Important Child Tax Credit Dates You Need To Know

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Payment Begin In One Month July 15 Wfmynews2 Com

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

If You Got The 2021 Child Tax Credit Watch For This Letter

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

Child Tax Credits 2021 And 2022 What To Do If You Didn T Get Your Payment The Us Sun